Fig. 1 Finished Motor Gasoline does not include blending components

Fig. 1 Finished Motor Gasoline does not include blending components

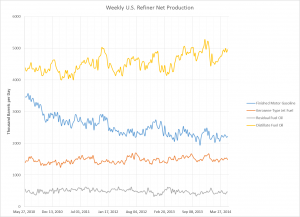

The EIA provides a plethora of data on U.S. petroleum fuels production. The “Weekly U.S. Refiner Net Production” graph (Fig. 1) illustrates the comprehensive “Weekly Petroleum Status Report”. The “WPSR Highlights” provide a condensed sketch of the report. During the week ending May 16, 2014, U.S. refineries operated at 88.7% capacity, consuming 15.9 million barrels of crude oil per day and producing 9.6 million barrels of gasoline and 5.0 milion barrels of distillate fuel oil. The U.S. imported 6.5 million barrels per day as well as over 1.1 million barrels of finished gasoline, gasoline blending components, and distillate fuel. Given that roughly 60% of a barrel of crude oil is used to produce gasoline, diesel fuel, and heating oil, and thus that imports account for 3.5 times that of finished imports, it is safe to say that U.S. refineries are essential components in the U.S. As my classmate readily points out, the U.S. is bridging the gap between imports and exports. However, it is unclear whether the domestic production is sustainable. As tight oil extraction continues, the world is only one subsea engineering feat away from revitalizing easy oil.

Along with weekly reviews, the EIA provides quarterly forecasts of the petroleum fuels market. As Memorial Day approaches and summer vacations commence, the EIA predicts the price of gasoline to increase slightly above the prices from this time last year before dipping below last year’s numbers for the remainder of the year. This trend correlates to crude oil prices, and ultimately results from an expected overproduction from the non-OPEC supply, especially in North America.

The most notable trend in Fig. 1 is noted in the Annual Energy Outlook 2014: gasoline production is declining while distillate fuel production increases. The EIA anticipates more gasoline-producing refineries to either convert to distillates or increase capacity to meet the market demand.

U.S. crude oil stocks are very high compared to the 5-year average. The distillate fuel stock is below average which might also imply a regression to the mean with increased imports and domestic refinery capacity.

Fig. 2 Distillate fuel oil includes No. 1, No. 2, and No. 4 distillate

Fig. 2 Distillate fuel oil includes No. 1, No. 2, and No. 4 distillate

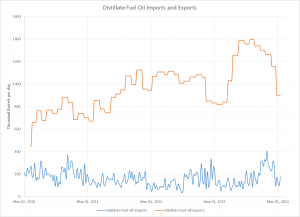

Notably, the conflict in Crimea may not have noticeably impacted the recent refinery outputs, but it may account for the decline in U.S. exports of distillate fuel oil. While distillate fuel oil consists of many uses, from space heating to diesel engines, “Distillate Fuel Oil Imports and Exports” (Fig. 2) displays a sharp decrease in exports and imports after the week of Russia’s occupation of Crimea. Despite this period of March, April, and May being termed the refinery maintenance season, this span of time includes a critical period of market uncertainty. Crimea already faces fuel shortages. Germany could face price surges, as pressure increases to diversify crude oil and natural gas imports.

The refinery exemplifies the peak of fuel chemistry application, with each refinery having unique capacity, inputs, and products. The environmental concerns posed by greenhouse gas emissions from internal combustion engines is mitigated within the refining process. A baghouse is used to capture particulate matter. Sulfur content may be removed through hydrodesulfurization or hydrotreating. Volatile metallic compounds are extracted by precipitation using a solvent such as propane. All of these processes are either energy-intensive and/or materials intensive, and would greatly benefit from regenerative solvents and materials.

References:

- Pricing Highlights: http://www.eia.gov/petroleum/marketing/monthly/pdf/hilites.pdf

- Supply Overview: http://www.eia.gov/petroleum/supply/weekly/pdf/highlights.pdf

- http://www.nytimes.com/2014/05/18/world/europe/in-taking-crimea-putin-gains-a-sea-of-fuel-reserves.html?_r=0

- http://www.reuters.com/article/2014/04/25/ukraine-crisis-crimea-energy-idUSL6N0NH4NR20140425

- http://www.eia.gov/forecasts/steo/special/summer/2014_summer_fuels.pdf

- Supply Data: “blog 1 data.xls”

- Petroleum Refining