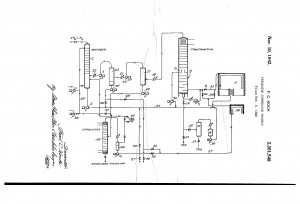

The process engineering of refineries undertook rapid changes in the past century, especially during the WWII. While pre-WWI refineries expanded their crude oil feed capacities based on economies of scale and scope, the demand for fuels rose exponentially with the popularization of the automobile. Shortly afterwards, WWI excited an even greater market shift towards increased fuel production. The stability of this fuel, measured by octane number, was rapidly increasing with newly developed catalytic processes (reforming, FCC, and alkylation) that would ultimately overtake thermal cracking. After being developed during the heat of WWII, these new processes would not take place in industry until the 1940s.

Perhaps the title is misleading: WWII was not the first war to require innovations to power a victorious campaign. Previous wars would experience horse-powered cavalries, wind-powered navies, and whale oil. All of these adaptations of warfare required visionaries to take their current environment and use it to their benefit. The trend remains consistent to this day: innovation drives energy density and stability of fuels (one horsepower is a bit outdated). Nevertheless, the military-industrial fossil fuels complex remains an ever-changing geopolitical case study. As new processes are developed, novel products and byproducts flood the market with tremendous potential to further the flexibility of the refinery.

Perhaps the most element in this stage of the oil and gas industry was the environmental tradeoffs that were made for the end goal of fuel efficiency. Tetra ethyl lead, a gasoline additive that has since been prohibited from use due to health and environmental hazards, was the perfect example of the military-fuel complex forcing geopolitical agendas without the immediate environmental concern. In this case, as in many times of war, citizens and elected officials will pay more attention to military mobilization than ecological conservation. In order to prevent such mistakes from taking place again, government agencies must work with media networks to promote federal registers and public comment periods for specific geopolitical developments, especially as they pertain to the way we power the world.